Investing in a Gold Individual Retirement Account (IRA) has become more and more fashionable as individuals seek to diversify their retirement portfolios and protect their wealth against economic uncertainties. This article will present a comprehensive overview of what a Gold IRA is, its benefits, the strategy of setting one up, and necessary issues to remember.

What is a Gold IRA?

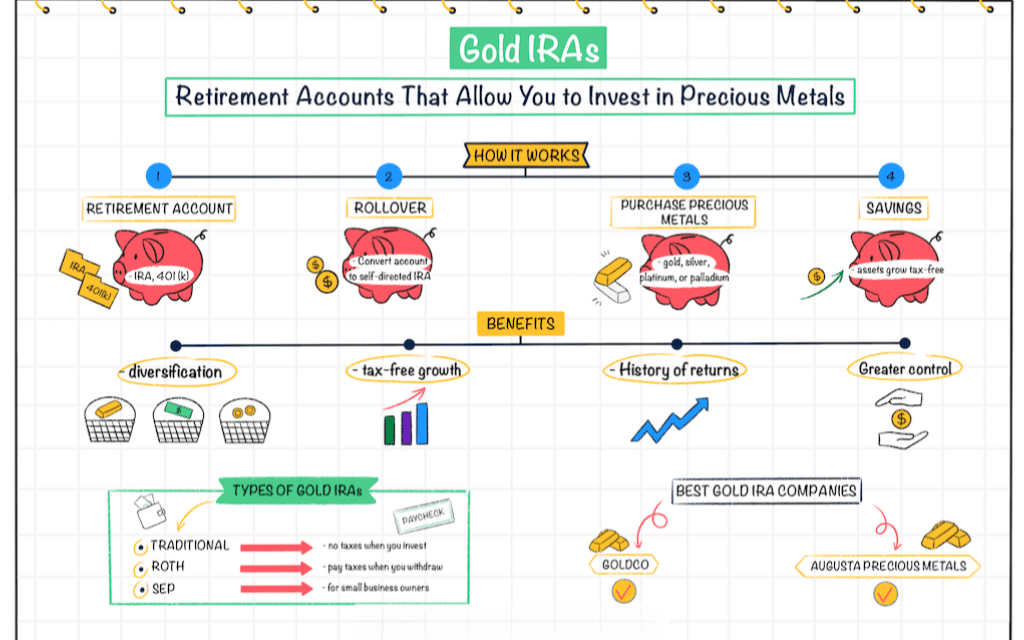

A Gold IRA is a kind of self-directed Particular person Retirement Account that permits investors to carry bodily gold and other precious metals as part of their retirement savings. Unlike traditional IRAs that usually hold stocks, bonds, or mutual funds, a Gold IRA permits the funding in tangible assets comparable to gold coins, bars, silver, platinum, and palladium. This investment automobile is governed by the same IRS rules as conventional IRAs, meaning it presents tax advantages whereas allowing for the inclusion of treasured metals.

Advantages of Investing in a Gold IRA

- Hedge In opposition to Inflation: Gold has traditionally been considered a safe-haven asset, especially throughout instances of economic instability and inflation. When the worth of paper foreign money declines, the price of gold typically rises, providing a hedge towards the loss of buying energy.

- Portfolio Diversification: Together with gold in your retirement portfolio can scale back total risk. Precious metals typically have a low correlation with traditional asset lessons, which means that when stocks and bonds are underperforming, gold should still hold or increase its worth.

- Tax Benefits: Like other IRAs, a Gold IRA provides tax-deferred growth. This means that you do not pay taxes on your positive aspects till you withdraw funds from the account, permitting your investments to develop with out quick tax implications.

- Protection from Economic Uncertainty: In times of geopolitical tensions or financial downturns, gold typically retains its worth higher than other investments. If you cherished this article therefore you would like to collect more info relating to Krishnacareers.com kindly visit our web-site. This makes it a dependable asset during unsure occasions.

- Physical Ownership: With a Gold IRA, you might have the choice to own physical gold, which might present peace of thoughts for many buyers. Not like stocks or bonds, that are paper property, gold is a tangible asset which you could hold.

Tips on how to Arrange a Gold IRA

Setting up a Gold IRA entails a number of steps, which are outlined below:

- Choose a Custodian: The first step in establishing a Gold IRA is to select a qualified custodian. This can be a monetary institution that specializes in managing self-directed IRAs and is accountable secure options for investing in gold holding your bodily gold. Make sure that the custodian you select is IRS-authorized and has a superb status.

- Fund Your Account: You can fund your Gold IRA by a wide range of strategies, including a rollover from an current retirement account (like a 401(okay) or traditional IRA), or by making a direct contribution. Bear in mind of the annual contribution limits set by the IRS.

- Choose Your Precious Metals: As soon as your account is funded, you'll be able to choose which types of treasured metals to spend money on. The IRS has specific pointers relating to the sorts of gold and different metals that can be included in a Gold IRA. For instance, only certain gold coins (just like the American Gold Eagle) and bullion bars that meet minimum purity requirements are eligible.

- Buy and Retailer Your Gold: After deciding on your metals, your custodian will facilitate the acquisition and make sure that your gold is saved in an IRS-accepted facility. It is necessary to notice that you can not take bodily possession of the gold whereas it is in your IRA.

- Monitor Your Funding: As with all funding, it's essential to regulate the efficiency of your Gold IRA. Regularly evaluate your portfolio to make sure it aligns together with your retirement goals.

Important Issues

While investing in a Gold IRA could be a useful technique, there are several important factors to contemplate:

- Fees and Costs: Gold IRAs can include various charges, together with setup fees, storage charges, and transaction charges. It’s important to grasp these prices upfront and factor them into your tax-efficient investment in gold iras decision.

- Market Volatility: While gold ira investment strategies 2024 is often seen as a protected-haven asset, it is not immune to market fluctuations. The price of gold may be risky, and it’s necessary to be prepared for potential worth swings.

- Liquidity: Selling physical gold can take longer than selling stocks or bonds. In case you require immediate entry to cash, you could face challenges in liquidating your gold holdings.

- IRS Regulations: The IRS has particular guidelines concerning Gold IRAs, including the varieties of metals that can be included and the storage requirements. Failing to comply with these laws can lead to penalties and taxes.

- Long-Time period Dedication: A Gold IRA is a long-time period investment technique. It’s important to have a clear understanding of your retirement timeline and financial goals before committing to one of these funding.

Conclusion

Investing in a top gold ira investment guides IRA can be a strategic move for those looking to diversify their retirement portfolios and protect their wealth against financial uncertainties. By understanding the advantages, the setup process, and the important issues concerned, buyers could make knowledgeable decisions about whether a Gold IRA aligns with their long-term monetary targets. As with all funding, it's advisable to conduct thorough research and seek the advice of with a monetary advisor to make sure that a Gold IRA matches inside your general retirement strategy. With cautious planning and consideration, a Gold IRA can be a worthwhile addition to your retirement financial savings plan.