Introduction: A Shift Toward Practical Financial Solutions

Many individuals recall moments when unexpected expenses forced difficult decisions, highlighting the importance of accessible financial guidance. The increasing demand for reliable services has drawn attention to the role of Family Financial Services Incorporated in offering clarity to those navigating personal finance. As more people seek structured support, the significance of dependable options becomes evident. This article explores how financial knowledge and clear loan pathways can empower individuals to manage challenges effectively, particularly when trustworthy information is available at the right moment.

Understanding the Need for Modern Financial Support

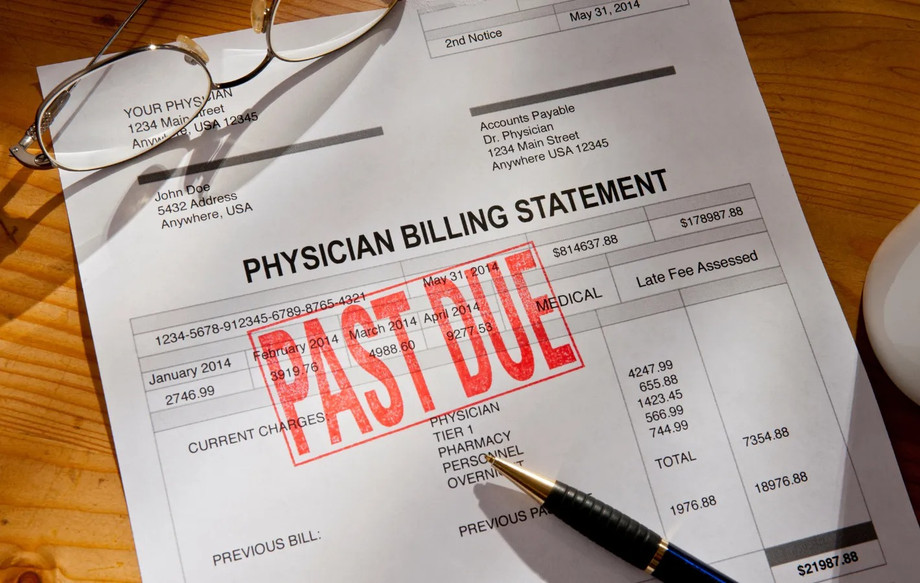

Consumers today often face complicated economic conditions that require balanced decisions, and the presence of Family Financial Services Incorporated in public discussions reflects this growing awareness. Financial stress can emerge from medical bills, vehicle repairs or sudden life changes, creating situations where informed choices matter. Access to guidance encourages individuals to evaluate options more confidently. When dependable assistance is available, it becomes easier to maintain focus on long-term goals rather than reacting impulsively to temporary setbacks.

The Growing Role of Community-Centered Financial Resources

Communities benefit when support systems offer transparent pathways and reduce confusion around borrowing choices, especially for those unfamiliar with loan structures. This environment encourages responsible management and helps individuals understand how decisions today affect future stability. By engaging with services that prioritize clarity, borrowers gain opportunities to navigate processes more strategically. Trustworthy financial information enables people to weigh terms, expectations and repayment structures in ways that reduce stress and support healthier long-term outcomes.

Exploring Local Loan Opportunities for Daily Needs

Many people explore Personal Loans Corinth MS when facing time-sensitive financial needs, especially when traditional credit options feel overwhelming. The presence of trusted lenders helps residents evaluate circumstances with greater confidence, and understanding available terms can significantly influence decision-making. Individuals who consider Personal Loans Corinth MS often look for reliability in service providers who respect budget limitations and personal goals. Clear explanations allow borrowers to make choices that align with their immediate obligations and long-term expectations.

How Specialized Local Banks Shape Borrowing Experiences

Residents searching for institutions like a Personal Loan Bank Corinth MS often appreciate straightforward communication that simplifies the borrowing experience. When individuals compare options among providers similar to Personal Loan Banks Corinth MS, they gain insights into factors such as interest expectations, repayment frameworks and eligibility requirements. This clarity supports responsible borrowing habits, allowing individuals to approach financial commitments with realistic timelines. Thoughtful decision-making becomes easier when information is presented in a way that reduces uncertainty.

Conclusion: Building Confidence Through Informed Financial Choices

Enhanced awareness of local lending options strengthens the ability of individuals to manage personal goals effectively. Borrowers who rely on reputable guidance experience clearer pathways as they evaluate terms, needs and responsibilities, particularly when community-focused institutions offer accessible information. By exploring trustworthy solutions and reviewing supportive resources through familyfinancialservices.net, individuals can approach financial decisions with greater stability. A service-oriented mindset shapes healthier financial habits, and Family Financial Services Incorporated ultimately demonstrates how informed guidance contributes to long-term personal confidence.